Financial Literacy & Housing: The Ultimate Strategy for Family Financial Planning NZ

Family financial planning nz is the absolute cornerstone of long-term stability and generational wealth for households navigating the unique economic terrain of Aotearoa New Zealand. In an era marked by fluctuating interest rates, evolving tax legislations, and a competitive property market, having a robust roadmap is no longer optional—it is a necessity. This comprehensive guide serves as the definitive manual for New Zealand families looking to integrate financial literacy, housing security, healthcare provision, and education planning into a single, cohesive strategy. We explore the intricate balance between managing immediate costs and investing in a future that provides security for your children and peace of mind for your retirement.

Table of Contents

- The Strategic Importance of Family Financial Planning NZ

- Core Components of Effective Family Financial Planning NZ

- Housing as a Wealth-Building Tool in Family Financial Planning NZ

- Maximizing KiwiSaver and Long-Term Investments

- Integrating Education and Healthcare into Your Financial Framework

- Legal Protections: Trusts, Wills, and Asset Management

- Final Thoughts and Key Takeaways

The Strategic Importance of Family Financial Planning NZ for Modern Households

When we discuss family financial planning nz, we are addressing a holistic approach that goes far beyond simple budgeting. In the New Zealand context, households face specific challenges such as the high cost of living in urban centers like Auckland and Wellington, the impact of the Official Cash Rate (OCR) on mortgage repayments, and the shift in educational funding models. A professional approach to financial planning ensures that a family can weather economic downturns without sacrificing their quality of life.

Financial literacy in New Zealand has become a focal point for government agencies and private institutions alike. Organizations such as Sorted.org.nz emphasize the need for New Zealanders to understand the mechanics of debt, the power of compound interest, and the necessity of emergency funds. By mastering these concepts, families can move from a state of financial reactive living to one of proactive growth. This transition is essential for achieving milestones such as homeownership or funding tertiary education for the next generation.

Core Components of Effective Family Financial Planning NZ

To build a resilient financial structure, families must focus on several key pillars. These components act as the foundation for all subsequent decisions regarding housing, investment, and lifestyle choices. Within the framework of family financial planning nz, the following areas are non-negotiable:

- Cash Flow Management: Understanding the net income after PAYE (Pay As You Earn) tax and ACC levies.

- Debt Elimination Strategies: Prioritizing high-interest consumer debt before tackling long-term liabilities like mortgages.

- Risk Management: Utilizing life insurance, income protection, and trauma cover to safeguard against the unexpected.

- Tax Efficiency: Leveraging tools like the ‘Working for Families’ tax credits and ensuring correct PIR (Prescribed Investor Rate) settings for investments.

Effective cash flow management involves a granular look at household spending. Many New Zealanders find success using the ’50/30/20′ rule, adapted for the local market: 50% for needs (rent/mortgage, utilities, food), 30% for wants, and 20% for savings or debt repayment. However, given the current rental prices in major cities, these ratios often require professional adjustment to remain realistic.

Housing as a Wealth-Building Tool in Family Financial Planning NZ

In New Zealand, the family home is often the largest single asset in a portfolio. Therefore, housing decisions are inseparable from the broader context of family financial planning nz. Whether you are a first-home buyer looking to utilize the First Home Grant or an investor managing a rental portfolio, the strategy must be precise.

The New Zealand housing market has undergone significant regulatory changes recently, including the adjustment of the Bright-line property rule and the reintroduction of interest deductibility for residential landlords. For families, the primary focus remains on equity building. By paying down the principal of a mortgage faster through offset accounts or revolving credit facilities, families can save tens of thousands of dollars in interest over the life of the loan. According to data from the Reserve Bank of New Zealand, even a small increase in regular repayments can significantly shorten the mortgage term.

Mortgage Structures and Interest Rate Cycles

Choosing between fixed and floating interest rates is a critical decision. Fixed rates provide certainty for budgeting, while floating rates offer flexibility for lump-sum repayments. A common strategy in NZ is ‘laddering’ fixed terms—splitting the mortgage into multiple portions with different expiry dates (e.g., 1-year, 2-year, and 3-year terms). This mitigates the risk of the entire loan renewing at a peak in the interest rate cycle.

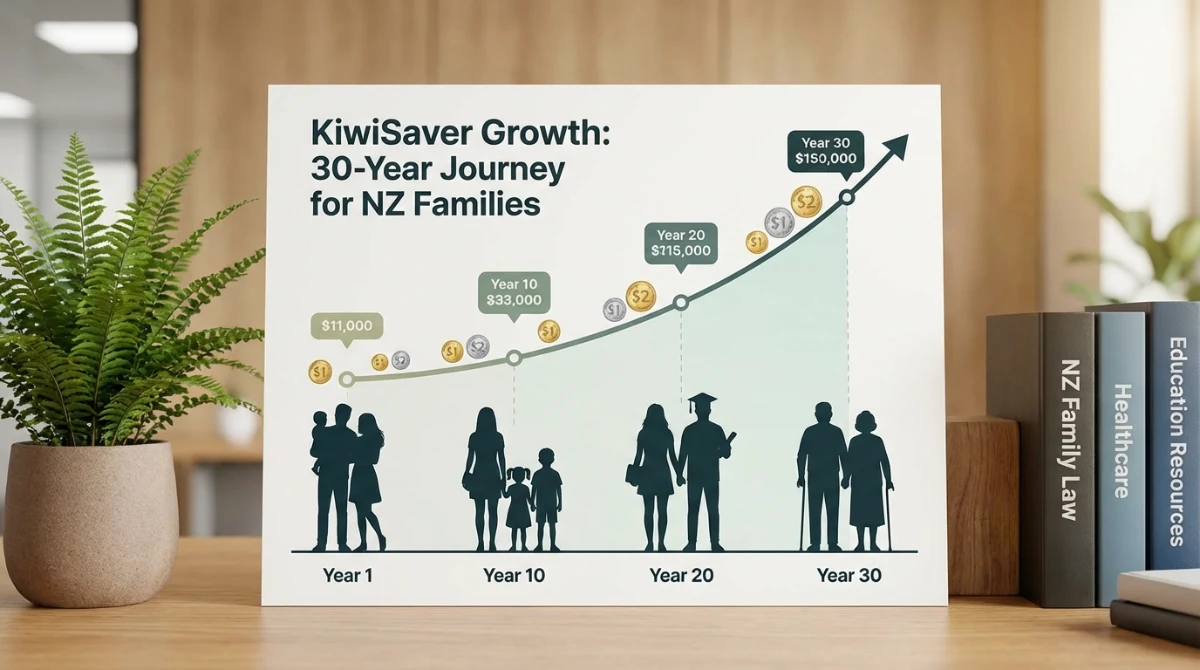

Maximizing KiwiSaver and Long-Term Investments

KiwiSaver is perhaps the most powerful tool available for family financial planning nz. Since its inception, it has revolutionized how New Zealanders save for retirement and their first homes. However, many families remain in ‘default’ funds, which may not align with their long-term goals or risk tolerance.

- Choosing the Right Fund Type: Families with a 20+ year horizon should generally consider Growth or Aggressive funds to capitalize on market volatility, while those nearing retirement or a house purchase might prefer Conservative or Cash funds.

- Maximizing Government Contributions: Ensure you contribute at least $1,042.86 annually to receive the full $521.43 government member credit.

- Employer Matching: At a minimum, contribute the 3% required to trigger the employer match—this is essentially a 100% immediate return on your investment.

- Kids’ KiwiSaver: Starting a fund for children early allows them to benefit from decades of compounding interest and makes them eligible for the first-home withdrawal later in life.

Integrating Education and Healthcare into Your Financial Framework

New Zealand offers a robust public system for both education and healthcare, but reliance solely on the state can sometimes lead to unexpected financial strain. In the context of family financial planning nz, proactive allocation for these sectors is vital.

The Cost of Education in NZ

While primary and secondary schooling is ‘free’ in state schools, families should budget for ‘voluntary’ donations, uniforms, extra-curricular activities, and technology requirements (BYOD – Bring Your Own Device). For those considering private education, fees can range from $15,000 to $30,000 per annum. Planning for tertiary education is also paramount. While the ‘Fees Free’ policy provides some relief for the first year, subsequent years, along with living costs (Student Loans), require careful management. Using a dedicated savings vehicle or a targeted investment fund for children’s education can prevent the need for high-interest borrowing later.

Healthcare: Public vs. Private

The NZ public health system, funded through general taxation and the ACC (Accident Compensation Corporation), is excellent for acute and emergency care. However, for elective surgeries and specialist consultations, wait times can be lengthy. Private health insurance (e.g., Southern Cross, nib) is a common component of family financial planning nz. It ensures that family members can access treatment quickly, minimizing the time off work and the associated loss of income. When choosing a plan, families should look for ‘surgical’ cover as a priority.

Legal Protections: Trusts, Wills, and Asset Management

No financial plan is complete without legal safeguards. In New Zealand, the Relationship Property Act 1976 and the Trusts Act 2019 have significant implications for how assets are held and distributed. Professional family financial planning nz involves consulting with legal experts to ensure your assets are protected for your heirs.

Family Trusts were historically used for tax avoidance, but today their primary purpose is asset protection and succession planning. A trust can protect family assets from business creditors or relationship property claims. Similarly, having an up-to-date Will and Enduring Powers of Attorney (EPA) is essential. An EPA ensures that if a parent becomes incapacitated, a trusted individual can manage their financial affairs and make health decisions without a costly and slow court process.

Final Thoughts and Key Takeaways

Effective family financial planning nz is an ongoing process of assessment, adjustment, and discipline. By integrating housing strategies with KiwiSaver optimization, education planning, and robust legal protections, New Zealand families can build a fortress of financial security. The key is to start early, stay informed about legislative changes, and utilize the professional resources available in the market. Whether you are navigating the complexities of the Inland Revenue (IRD) tax codes or applying for your first mortgage, a clear plan is your greatest asset.

Key Takeaways for NZ Families

- Start Early: The power of compound interest in KiwiSaver and early mortgage repayments cannot be overstated.

- Balance the Pillars: Don’t focus on housing at the total expense of liquid savings or insurance.

- Seek Professional Advice: Financial advisers and lawyers provide a perspective that can save you thousands in the long run.

- Review Annually: Economic conditions change; your financial plan should be a living document that evolves with your family.

- Utilize Tools: Use government calculators for tax credits and mortgage repayments to keep your data accurate.